There is little in this world that makes Almost DailyBrett more warm and fuzzy than: “Buy Low Sell High.”

At the 2018 going away party for your author given by Central Washington University public relations students, they all started chanting — you got it — “Buy Low Sell High!”

The axiom not only leads to a profit margin, but more importantly it signifies an optimistic view of life. Everyone had enough pessimism in 2020 to last a lifetime. Turning into 2021, it’s time to celebrate and treasure our cherished and hard-won economic freedom.

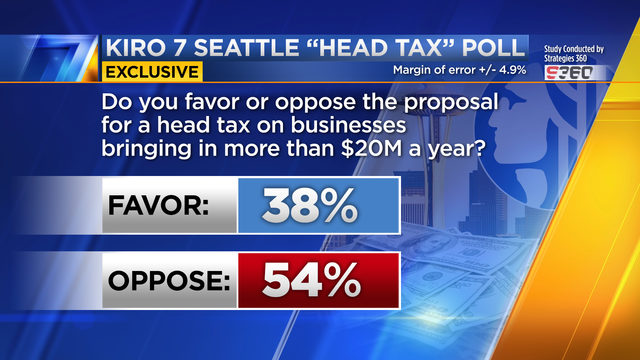

If entrepreneurs are treated badly, only seen as a source of ever-higher tax revenues, they have the freedom in this exceptional country and other enlightened nations to move to another state, to another land.

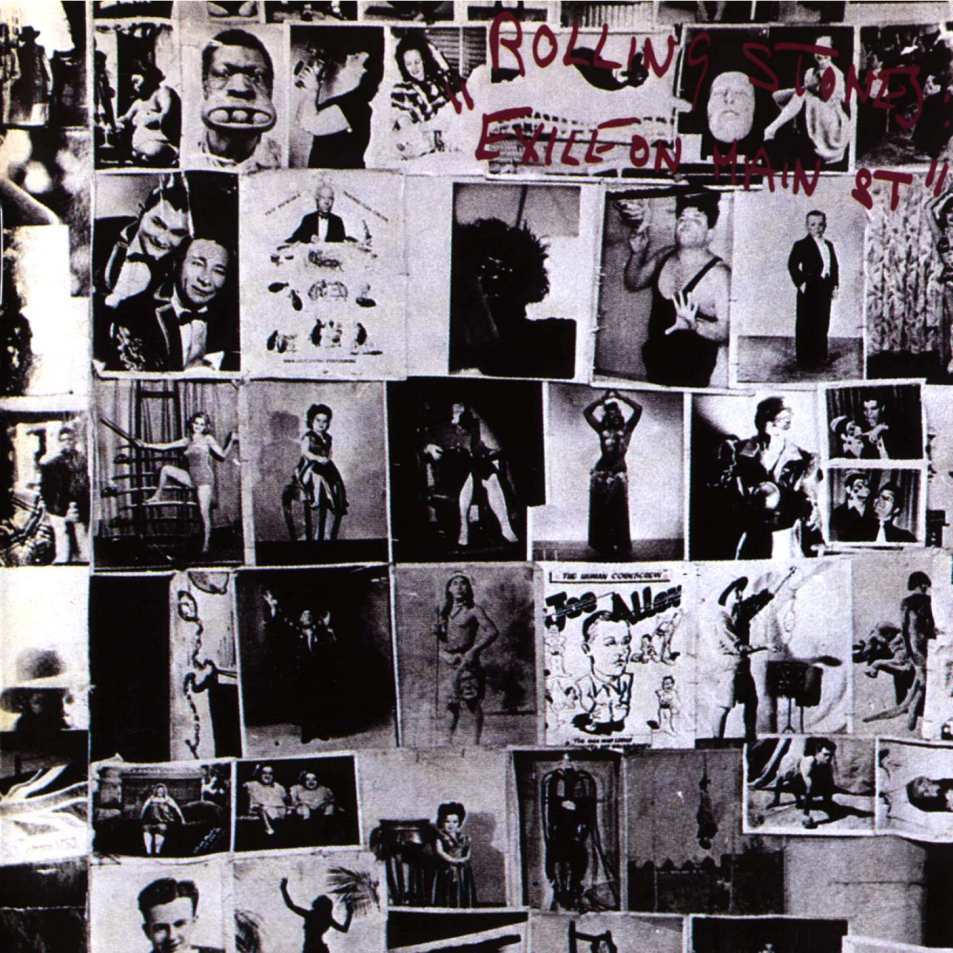

Almost DailyBrett wrote about the Rolling Stones leaving the United Kingdom and its effective 98 percent tax rate (e.g., confiscation) for France in the 1970s.

Today California businesses (i.e., Charles Schwab moving to Dallas, Hewlett Packard Enterprise departing for Houston, Oracle relocating to Austin and Elon Musk heading to Texas) are pulling up stakes for the no-income tax, pro-business Lone Star State.

Keep in mind that Charles Schwab, HP, Oracle et al. were Bay Area/Silicon Valley business pioneers, helping to build the Golden State into the 5th largest economy in the world. Now they are leaving with so many others for Buy Low Sell High Texas.

It’s not a mere anomaly. It’s a canary-in-the-mine trend. Does anyone in Sacramento even notice, let alone care?

“Tax the rich, tax the rich, tax the rich. We did that. God forbid the rich leave.” — New York Governor Andrew Cuomo

When given a choice between economic freedom and command and control, entrepreneurs will select the former because it gives them right to indeed Buy Low Sell High. If a company making great products, its employees and its shareholders are barely tolerated, much less appreciated and even scorned, there are obvious choices to be made.

Transplanted Cubans and Venezuelans in Florida have zero misconceptions about socialism. The system failed in their former countries and does not work now. Worse, dictatorship of the proletariat is cruel and ruthless and does not respect the rights of the individual. They are just pawns on the chess board of life.

The War On Profits

There are way too many who object to what they call “profiteering” (new verb), even though they worked for years for publicly traded companies. Some still can’t read an income statement or make sense of a balance sheet. And yet they are making economic policy in California and other one-party states.

Let Almost DailyBrett make it plain and simple: the profit is on the bottom line. It’s achieved by hiring and purchasing carefully (e.g., Buy Low) and manifested when sales exceed costs (e.g., Sell High). Your author does not have a business degree, but understands and embraces this proven concept.

“You know economists; they’re the sort of people who see something works and wonder if it would work in theory.” — Ronald Reagan

Buy Low Sell High works well in both practice and theory.

Nothing in life delights your author more than one of his former students landing a great position, many with a publicly traded company. They now are compensated for their labors with a competitive salary, a full range of benefits and if appropriate the ESPP (Employee Stock Purchase Plan) and in many cases, stock options.

They now have blessed financial serenity knowing they have put on their (airplane) mask first. Now they can help others.

“To whom much is given, much is required.”

In all due respect to Luke 12:48, Almost DailyBrett offers the following amendment: ‘To the optimists for whom much is earned, much is required.’

Buy Low Sell High!

Almost DailyBrett Note: My former student placed the above graduation photo on her Facebook page today to celebrate her birthday. Happy Birthday Tiara! May you have many more opportunities to Buy Low Sell High!

Buy Low And Sell High Millennials

Taxing the Fab Four; Exiling the Stones

California’s Rarefied Air Tax

California’s Heat Seeker Taxes