“Billionaires should not exist.” — Millionaire U.S. Senator Bernie Sanders (D-Vermont)

“Every billionaire is a policy failure.” — Rep. Alexandria Ocasio-Cortez (D-New York)

“Personal wealth is at best an unreliable signal of bad behavior or failing policies. Often the reverse is true.” — The Economist

Super talented and accomplished media superstar Oprah Winfrey is worth $3 billion.

Basketball Hall of Famer Michael Jordan’s net worth is $1.9 billion.

Hip-hop star/investor Jay-Z just made into the three-comma club at $1,000,000,000.

Did government fail when Oprah, Michael and Jay-Z all succeeded and thrived, each because of their hard work, fortitude, perseverance and incredible talent?

Did anyone of them trade on their … privilege?

Almost DailyBrett doesn’t remember Oprah engaging in insider-trading.

Do you, Secretary Reich?

Ditto for Michael Jordan profiting from a monopoly unless Mr. Reich is pointing to Michael’s near-monopoly of talent against the competition he faced night-after-night in the NBA?

Is Jay-Z guilty of fraud, a political payoff or did he inherit his wealth?

Wonder if any of these “basically 5 ways” to accumulate a billion dollars in America apply to Nike founder/Philanthropist Phil Knight?

Have you read “Shoe Dog,” Professor Reich? Nike almost went under about nine times.

The former Labor Secretary’s “5 ways” Twitter screed is intellectually dishonest, and remarkably easy to discredit.

Alas, it is beneath the respect normally afforded to Robert Reich. Next time go high Mr. Reich instead of racing to the bottom. Talented and hard working people can earn their wealth on their own without resorting to nefarious deeds.

From a policy standpoint, we need to ask:

Should we punish Oprah, Michael, Jay-Z, Uncle Phil and so many others who worked their tushes off to legitimately make their fortunes with a punitive Elizabeth Warren 6 percent wealth tax (up from the original 3 percent proposal), and income tax rates reaching 90 percent or beyond?

Whattyathink Senators Sanders and Warren?

Class warfare — born out of jealousy — is not new.

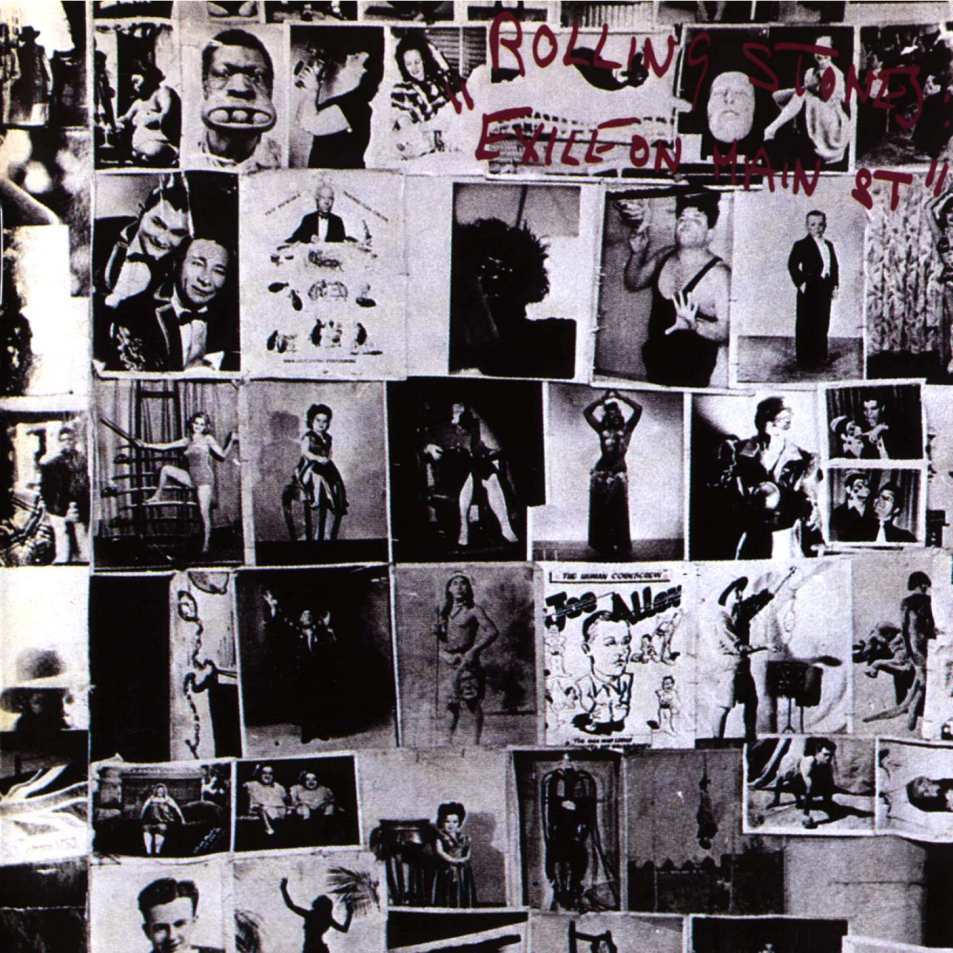

The effective tax rate for achievers in the United Kingdom in the 1970s once reached 98 percent. If you don’t believe Almost DailyBrett, ask The Beatles … ask The Rolling Stones, who fled to France and recorded “Exile On Main Street.”

Can a near 100 percent confiscatory tax rate, which was thankfully eliminated in the UK by former Prime Minister Margaret Thatcher, happen in the United States of America? Let’s hope not.

Celebrate Instead of Hate?

Almost DailyBrett remembers boys and girls practicing basketball, so they could be “Just Like Mike.”

Your author can imagine girls admiring and wanting to be the next Oprah.

You should check Ellen’s interview with Bill Gates. They discussed the works and deeds of the Bill and Melinda Gates Foundation, donating a cumulative $50.1 billion to fight global childhood poverty and to improve public schools in our country.

According to Forbes, Gates is worth approximately $96.5 billion — give or take a shekel or two — making him the second wealthiest homo sapien on the planet. Virtually everyone in the first world is using Microsoft’s Windows Operating System, inspired and written by Gates. And his charitable foundation has contributed more than any other non-profit ever to make our world a better place (more than most governments).

His former company Microsoft is valued at $1.14 trillion, generates $96.5 billion in annual revenues, and employs 144,000 in well paying positions with full benefits and stock options. Taken together, the performance of Microsoft as a company and the generosity of the Gates Foundation, puts Bill’s wealth into perspective.

Can we have more “policy failures” just like Bill Gates, Phil Knight, Oprah Winfrey, Michael Jordan, Jay-Z and so many more?

Instead of hating people who are wealthy, let’s celebrate and cheer for the achievers (e.g., Michael Jordan).

If we are concerned about billionaires, our policies should focus on stimulating competition (i.e., über-tough content streaming, video game, smart phone markets…), not limitless redistribution or punitive taxation.

If our political intent is to further divide, demonizing billionaires (as others have been publicly denigrated for ages) is a good way to engender one of the seven Deadly Sins: Envy.

If our goal is growth and prosperity, then let’s encourage Millennials and the generations, who will follow, to shoot for the stars. Let them become tomorrow’s Oprah, Michael, Jay-Z, Bill Gates and Uncle Phil.

And if they succeed financially, let’s celebrate them and at the same time root for competitors to keep them on their toes.

https://www.economist.com/leaders/2019/11/09/billionaires-are-only-rarely-policy-failures

https://www.gatesfoundation.org/who-we-are/general-information/foundation-factsheet